Hi Kensington Member Businesses!

What’s In This Issue?

• Weekends In Kensington + Neighbour Day June 17

• Non-residential Property Taxes

• Avenue Patio Finder

Weekends in Kensington + Neighbour Day

This summer is gonna be a hot one and we’re ready to turn up the dial with local arts programming all summer in #kensingtonyyc. Our community will feature local performers along 10th Street every Saturday and Sunday (June 17 – August 27) from 12:30 p.m. – 2:30 p.m. all summer long.

Weekends in Kensington kicks off with Neighbour Day on Saturday, June 17 — featuring art installations, live music by local artists and complimentary goodies from local shops.

Please email [email protected] and [email protected] if your business is interested in donating food, beverages, or other swag to the Weekends in Kensington events. Your donations are greatly appreciated and your businesses will be featured on social media posts related to the events.

Please free free to use the image below to promote the event on your socials and in your shops.

Poster

Instagram Post

Instagram Story

Hashtags: #WeekendsInKensington #KensingtonLove #KensingtonYYC

Full list of dates:

June 17

June 18

June 24

June 25

July 1

July 2

July 8

July 9

July 15

July 16

July 22

July 23

July 29

July 30

August 5

August 6

August 12

August 13

August 19

August 20

August 26

August 27

Non-residential Property Taxes

Are you concerned about high non-residential property taxes?

The Chamber of Commerce and the BRZs/BIAs want to reach out regarding a reoccurring issue we’ve been working on concerning non-residential property taxes. We have heard consistently from businesses across the City that they are worried about year-over-year increases in their property taxes. To support them, we have been advocating for City Council to shift the tax burden away from businesses.

To help get the message across, we hope to engage businesses interested in writing letters to their local City Councillors detailing the need for the shift; recognizing a shift will help alleviate the rising cost burden, and will bring us in line with other municipalities across the province and country. Attached are two media releases prepared by the Chamber that have been sent to members of the Council highlighting our position for background.

Also attached is a sample letter prepared by the Chamber. If you are eager to voice your concerns to Council, please see the sample for guidance.

Find your councillor and ward (calgary.ca)

Media Release 1

Calgary Chamber urges City Council to rebalance property tax

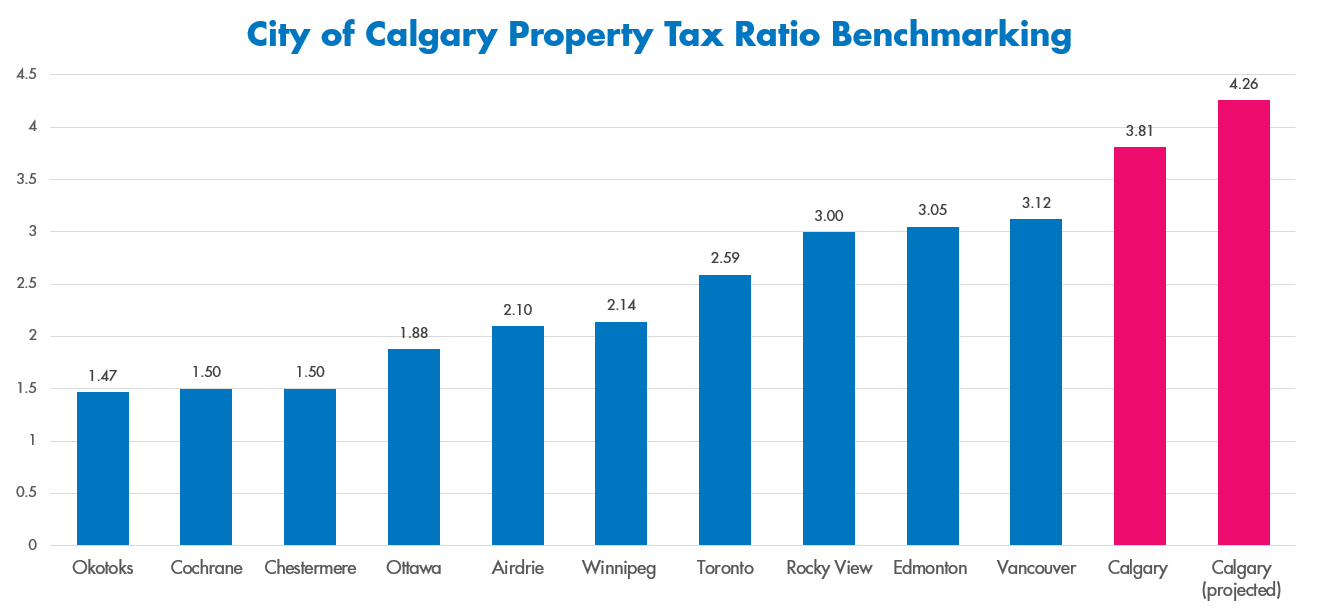

Calgary, February 14, 2023 – The Calgary Chamber of Commerce calls on City Council to rebalance residential and non-residential taxes, adopting an incremental shift of two per cent per year for the next four years. This will bring Calgary in line with other Canadian cities and bend the curve on an increasingly imbalanced property tax ratio between businesses and residents.

“Rebalancing the property tax ratio will help ensure Calgary remains an attractive place to start and grow a business, and will facilitate economic stability and resilience,” says Deborah Yedlin, President and CEO of the Calgary Chamber of Commerce. “As businesses across the city continue to grapple with rising costs, inflation and increased debt, immediate action is needed to support business growth. We urge City Council to commit to a two per cent shift from non-residential to residential annually until 2026, bringing the cost of doing business closer in line with other comparable and proximal cities.”

According to the Q4 Business Conditions Survey conducted in partnership with Statistics Canada, only 12.5 per cent of businesses anticipate growing this year. Businesses’ limited ability to grow is largely linked to cost pressures: 58.8 per cent of businesses remain concerned with rising inflation, while 43.4 per cent are concerned with the rising cost of inputs. Critically, coupled with the talent shortage and interest rates, businesses need all levels of government to reduce – not increase – the cost of doing business.

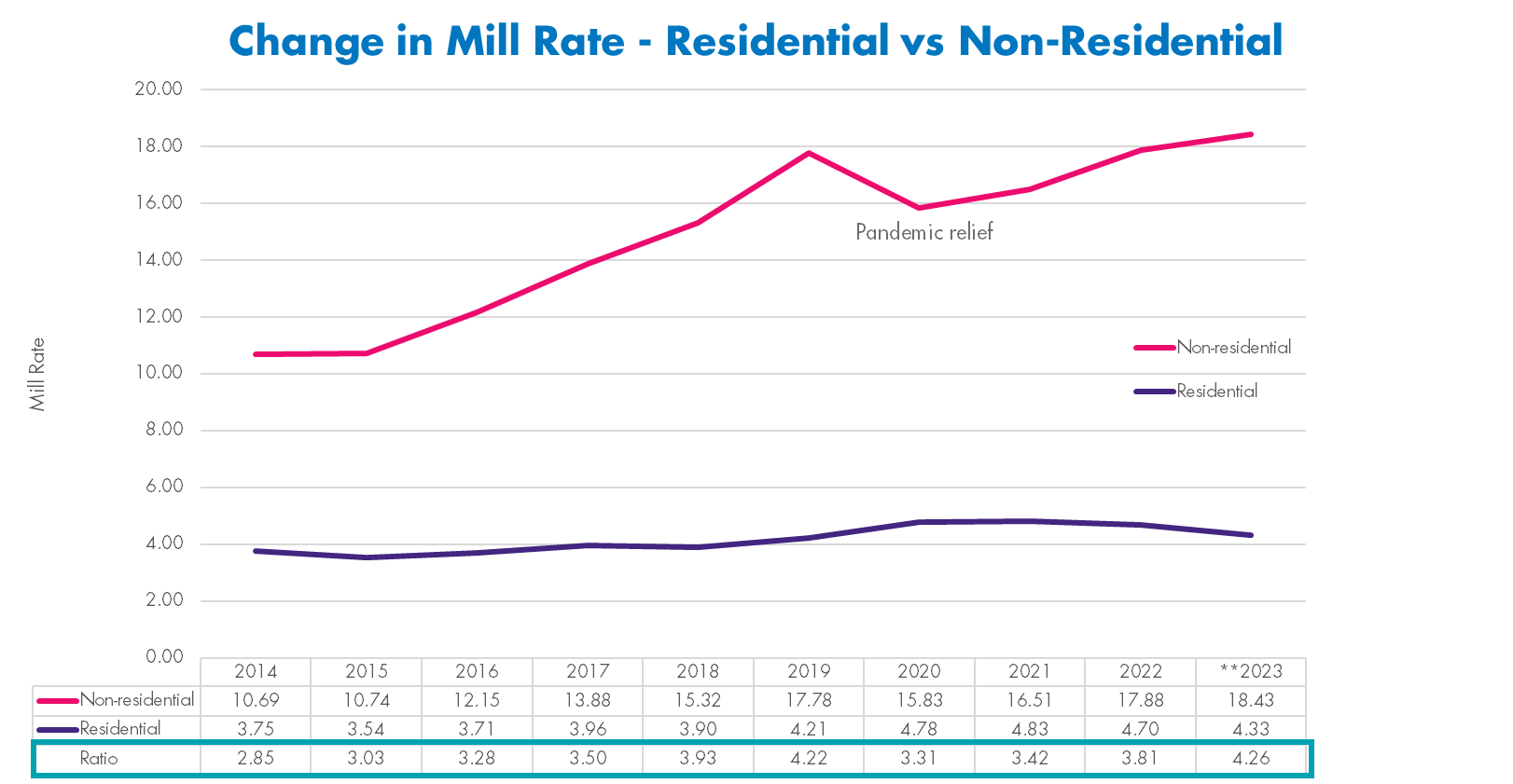

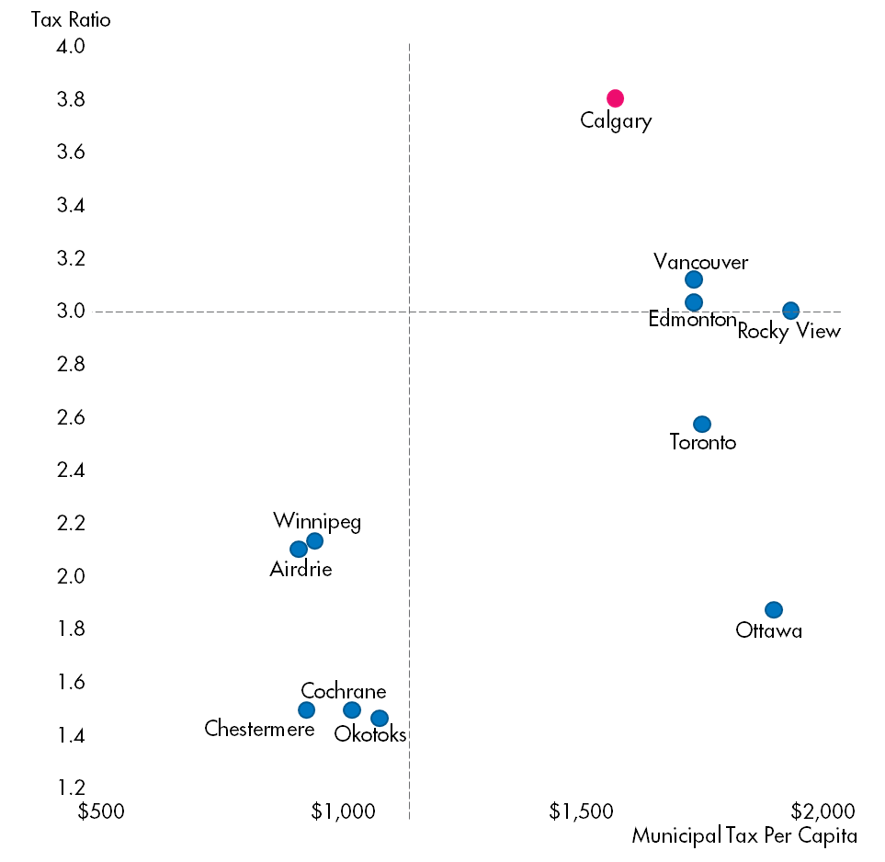

In 2021, businesses in Calgary paid 3.4 times that of a residential property owner in property tax, per $1,000 of assessed value. If left unaddressed, the ratio will climb to 4.26 to 1 in 2023 – the highest among comparable Canadian cities – by a significant margin. Without an immediate course-correction, Calgary will exacerbate our position as one of the least equitable tax jurisdictions in Canada, far surpassing both large urban centers and neighbouring communities.

Calgary’s vibrancy and economic resilience hinges on the well-being of our business community – across sectors, sizes and regions of the city. After several challenging years, businesses need government to help create an environment that facilitates business growth, enables businesses to hire staff and bring vibrancy to streetscapes, and diversify our economy.

–

ABOUT THE CALGARY CHAMBER

The Calgary Chamber exists to help businesses thrive. As the convenor and catalyst for a vibrant, inclusive, and prosperous business community, the Chamber works to build strength and resilience among its members and position Calgary as a magnet for talent, diversification, and opportunity. As an independent, non-profit, non-partisan organization, we build on our 131-year history to serve and advocate for businesses of all sizes, in all sectors, and across the city.

Media opportunities

For media inquiries, please contact Shannon Hazlett, Senior Public Relations Advisor, at [email protected].

Media Release 2

Calgary Chamber disappointed in City Council’s decision on property tax

The following statement on municipal property tax is attributable to Deborah Yedlin, President and CEO of the Calgary Chamber of Commerce:

Calgary, February 14, 2023 – “As the voice of business, we are disheartened by City Council’s decision to maintain the non-residential to residential tax ratio at 52 to 48 and are concerned that the tax ratio is projected to further increase to 4.26 to 1 in 2023. We are working to ensure Calgary is competitive, entrepreneurial and ripe with opportunity, however this decision runs counter to our identity of being ‘open for business’.

“We have been actively working with our business community and City Council on the importance of business viability and success in Calgary, knowing a thriving business community leads to a vibrant Calgary community more broadly. Businesses are the employers of many Calgarians, and we need a strong business environment to continue having a strong economy.

“We view the decision to maintain the status quo as a decision in favour of a further imbalance, as the ratio is projected to continue climbing. It leaves Calgary among the highest cost cities compared to nearby and other major Canadian cities, hampering business success. Rising costs, inflation and debt continue to impede business, and unequitable property taxes only add to this.

“As the Chamber, we will continue to advocate for a two per cent property tax shift in the coming years, as the City’s failure to adjust the property tax ratio hinders investment outlook for businesses and the city. The Chamber remains committed to advocating and advancing property tax measures that support long-term growth for businesses.”

ABOUT THE CALGARY CHAMBER

The Calgary Chamber exists to help businesses thrive. As the convenor and catalyst for a vibrant, inclusive, and prosperous business community, the Chamber works to build strength and resilience among its members and position Calgary as a magnet for talent, diversification, and opportunity. As an independent, non-profit, non-partisan organization, we build on our 131-year history to serve and advocate for businesses of all sizes, in all sectors, and across the city.

Media opportunities

For media inquiries, please contact Shannon Hazlett, Senior Public Relations Advisor, at[email protected].

Avenue Patio Finder

Avenue is launching a patio finder tool and wants it to be as comprehensive as possible. There is NO COST to be included in this list, which will appear on Avenue’s website.

We are asking the restaurants to fill in this form in order to be included: https://www.avenuecalgary.com/patio-submission/

The only required field is the name of your restaurant but of course, the more complete the information is the better and the earlier the form is filled in the sooner we can get each restaurant into the patio finder tool.